Are you set to retire comfortably in Singapore? What's missing & mistakes to avoid in our lifelong financial journey!

- ckcbiz40

- Aug 16, 2025

- 8 min read

HAPPY SG60 NATIONAL DAY! 😍 Came across this article from Straits Times over National Day and found it intriguing enough to pen a post here, especially as I review my own financial journey after my recent birthday and crossing into another milestone.

The writer did a great job exploring various financial aspects of our lives as we plan for, approach or reach our retirement, either by freedom of choice or by age. She touched briefly on CPF Life, discussions on sufficiency of nest egg amount, retirement lifestyle and living expenses, income streams, healthcare costs etc. Interestingly, the article centred quite a fair bit of the article on insurance adequacy, what to buy, how to plan and what policies to review/adjust/retain etc.

Whilst I fully agree with the importance of insurance adequacy and to plug gaps in our protection coverage (crucial enough for me to write a post recently here: Investing in your insurance coverage - Are you underprepared and underinsured? 🤔 Investment in Insurance = Good financial health!), I wanted to add on what I found could have been added on to contribute to the retirement sufficiency here, point out the mistakes to avoid and what to look out for.

Briefly, I hope to touch on the following to highlight: (i) planned for whilst assessing our retirement adequacy or (ii) mistakes to be avoided in our LIFELONG financial journey or

(iii) taken into consideration for the gaps we need to bridge till we reach our big "R":

(1) Expenditure/Spendings:

(a) Living Expenses - (1) Always live within our means (or better still, living BELOW our means!). No matter how much we earn, so long as we spend as much as or more than what we earn, we will be in trouble! We can be the highest paid doctor or lawyer or banker but once you stop working, your source of income dries up. Hence, why we need to watch our spendings.

(2) Avoid lifestyle inflation - As we earn more, our perception of wealth changes, we think we have more than we do and hence we tend to spend more! This is a mistake to avoid, as we should keep in check lifestyle inflation even as our earnings increases, or we climb up the corporate ladder. As the saying goes, "we do not want to spend money we haven't earn to impress people whom we don't know."

(b) Loans / Debts -

(1) Watch your debt servicing ratio (i.e. how much of your total monthly income we are using to service all our loans). The higher the ratio, the lesser we have for daily living and expenses and savings. Generally, recommend keep this debt svc ratio to below 40%.

(2) Imagine being buried in a mountain of credit card debt, car loan, mortgage loan, overdrafts, these can overwhelm borrowers, potentially leading them to pay only the minimum payments. With sky high credit card and loan interest and if we keep paying the minimum amounts, what's the chances that the balance will be paid off? Let's not even go down the Buy Now, Pay Later schemes or 0% interest free instalment schemes to entice consumers to buy, buy, buy! 😱

(c) Rainy Day fund / Bad mood budget -

(1) Set aside a small amount of monies every month or every year (e.g. could be a small % of your yearly increment which were never in your budget anyway) to cater for this rainy day fund (e.g. to cater for the spoilt air con, leaking roof, faulty TV, crashed laptop etc.) or simply to go for a short JB getaway or a short Batam staycation when life/work gets you down. You will be surprised how this bad mood fund or rainy day fund grows with time, IF you give it time to grow 😉

(d) Insurance premiums -

(1) Catering for these insurance premiums are a must! Life protection, personal accident, critical illness, long term care, hospitalisation shield plans. To go to the extreme, think of your body and health as a business and these insurance premiums as your business costs, so that you can earn revenue/make profits (i.e. earn your income)!

(2) Usually suggested to cover enough i.e. not to over-insure or under-insure. As a rule of thumb, it's usually recommended not to spend more than 20 to 30% of your income on insurance! You can refer to my previous post on sufficiency or gaps in our insurance coverage here: Investing in your insurance coverage - Are you underprepared and underinsured? 🤔 Investment in Insurance = Good financial health!

(3) And for those of us who financially savvy:- Buy Term (Insurance) and Invest the Rest! Do not comingle insurance protection with investment returns 😎

(2) Income/Savings:

(a) Salary Income -

(1) Budgeting is important to ensure we plan for savings, investments, insurance, living expenses and others. When we think about expenses, we usually focus on the big ticket items like holidays, furniture, car, handbags etc. But you will be surprised that small costs like your daily atas coffee or frequent taxi rides or weekly restaurant meals can add up substantially over time!

(2) Each month, we can try to review our spendings by listing our daily expenses on a spreadsheet or tracking our expenditure via a budgeting app. Don't overlook streaming subscriptions, impulse buys in the mall, unplanned grocery trips! Always be on a look out for cheaper alternatives by comparing or going for house brand products etc.

(b) Emergency Cash - (1) All of us will need an emergency fund, even if you are living with parents, is single or have no kids etc. This emergency fund acts as a buffer against unexpected job loss, sudden medical bills bomb, family needs etc. Without this emergency fund set aside, we are more likely to withdraw from our retirement bucket or encash our investments in times of need. This emergency fund should comprise of liquid cash held in savings account, Singapore Savings Bonds (SSBs), T-bills, fixed deposits etc. that can be easily converted into cold hard cash.

(2) Usually, the suggestion is to set aside an emergency fund of between 3 to 6 months of your living expenses. But I would be more kiasu and to set aside 6 to 12 months of our expenses especially if we are working in a niche role or if we are older/more advanced in our career path (i.e. harder/longer to find a job should we lose our rice bowl or decide to take a voluntary break).

(c) Savings -

(1) Your savings ratio tells you how much of cash you are saving from your gross monthly income. The higher this ratio, the greater the ability to meet your long-term goals. It is usually recommended to save at least 15% of your gross monthly income. However, to highlight, it doesn't mean this savings should be left in normal bank saving accounts to earn pittance 0.05% to 0.1% interest, these should be minimally put into high yielding savings account (more details in point (2) below). Personally, I put aside about 30% of my monthly income as savings but I invest them into stocks/DCA with Roboadvisors monthly.

(2) High yield savings accounts (HYSA) such as OCBC 360, UOB ONE account and DBS Multiplier to earn you higher than usual savings account interest. Ok, I know banks have been cutting the interest rates of this HYSA recently in view of the anticipated interest rate cuts but no matter what, they are still higher than the pathetic interest savings accounts are paying us, yes?

(3) Bonuses can be viewed as windfall (ok, I know some will argue it as a well-deserved reward), but when I say windfall, I meant this unexpected bonus money was never factored into our usual income vs expenditure in our day-to-day budgeting or plans. Hence, objectively, bonuses can a relatively painless way to turbocharge your savings yearly (on top of our monthly savings) or save for your next trip or big purchase or simply to pay down your loans/debts. Personally, before my bonus comes in, I have already planned to split it into several buckets, namely to invest into stocks, pay for overseas trip, allocate to Supplementary Retirement Sum (SRS) top-up or CPF top-ups to save on income tax and of course to supercharge my PIGGY BANK!

(d) Side income/freebies (essentially more bang for your buck) -

(1) Many a times, in our daily lives, we need to spend on e.g. home insurance, car insurance, electricity retailer contract, so why not get freebies from such necessary expenditures/purchases, e.g. petrol vouchers/shopping vouchers from insurance purchases, free fractional stocks/cash from PayNow for downloading + funding brokerage accounts, credit card rebates/bills discounts from signing up from electricity retailers or referral bonuses etc. [maybe I should pen a post on my "earnings" from these lobangs? haha...]

(3) Investments/Interests:

If you have been reading my past posts, you would know I'm a huge advocate of investing for financial growth, and hence I shall just briefly mention them here to avoid belabouring my points.

(a) Stocks/equities -

Investing in stocks on a regular basis, either by lump sum purchase or dollar cost averaging, which I had blogged about previously here: (i) My 10th Year Investing milestone: On stage as panelist for Diligence Investment Membership club meet-up(19 Jul 25) and (ii) My football team(stock portfolio)'s Starting 11! Can our reserve players substitute them? 🤔

(b) Dollar cost averaging -

This could be achieved through Roboadvisors, POSB's Invest-Saver, OCBC's Blue Chip Investment Plan (BCIP), the various brokers Regular Savings Plan (RSP), ETFs etc.

(c) Bonds / Deposits -

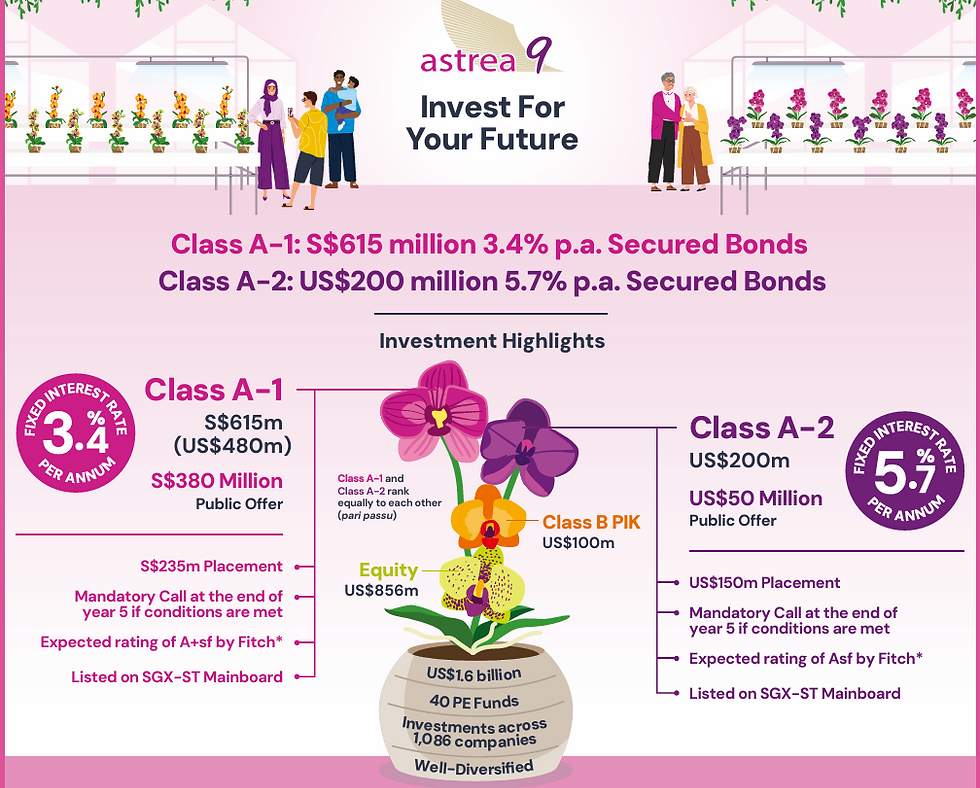

There's definitely a place for bonds/deposits in our investment portfolios to add a layer of stability and visibility of dividends/interest to add to our next pot of gold. This could be in the form of Singapore Savings Bonds, corporate bonds, fixed deposits or the latest Astrea 9 PE bonds which I have recently written about here: Temasek's Astrea 9 PE Bonds - 5Ws and 1H - Who? What? Where? When? Why Buy? How to Buy?

My MoneyandHealth's words of wisdom: [Financial literacy and money management skills is a lifelong journey... By penning my thoughts above regarding the various aspects of our financial lives, I hope to raise the financial mindfulness and personal finance expertise that can be accumulated and compound to be transformative in our financial journey and even contribute to our retirement goals!

You may be a financial savvy expert who already know most of the pointers mentioned above, or you could be a money noob who could benefit immensely from incorporating several of the above factors into your life. No matter what, if nothing else, I hope you have absorbed some nuggets of wisdom or at least gave you some budding ideas or bits of food for thought as you embark on your own financial evolution path and wealth mastery pursuit! 🥰]

Disclaimer: The above article is just the author expressing his layman views. It is NOT financial advice, and NOT a recommendation to buy or sell any stocks or REITs. Pls do your own due diligence and/or consult a qualified financial advisor before making any moves or taking any actions. Pls note that past performance is not an indicator or guarantee of future performance or potential.

To your money and health,

Mr MoneyandHealth (Mr MH) 🥰

Comments