Investing in your insurance coverage - Are you underprepared and underinsured? 🤔 Investment in Insurance = Good financial health!

- ckcbiz40

- Jul 26, 2025

- 7 min read

Saw this Business Times article and forwarded to my family members and close friends, but was surprised/shocked by some of the responses I received thereafter:- (i) "Aiyah, the insurance company is trying to scare us into buying more insurance", (ii) "How much coverage would be considered as sufficient?,

(iii) "Don't know what coverage is necessary and what is extra leh".

Disclaimer: I am NOT endorsed by any insurance company/provider to write this post. Everything expressed here is my own opinion and arose from my own nagging unease as I was surprised and/or shocked that some or many of us still have such queries/uncertainties to our insurance coverage and not taking any actions.

Background: Many of my family/friends whom I forwarded the Biz Times article to are in their 30s, 40s, 50s, with parents and married with children to look after. I shall not belabour the well-known fact of rising medical cost in Singapore, especially with a rapidly aging population and dwindling next generation to depend on (if we can even depend on them 😆). While the Biz Times article pertains to long term care insurance, I felt a need to review other aspects of insurance too.

Important: While the subject matter here is insurance, I also want to highlight in investment methodology, there is a saying - "If you cover the downside, the upside will take care of itself". In this case, wouldn't you agree that INVESTING in insurance coverage equals to covering the downside in our financial health? Otherwise, without foresight of sufficient investments in your investment coverage, no matter how well your investments make, your medical needs/bills will drain your money away! 🥶

Context: Before I start sharing/review, just wanted to highlight that insurance is a very PERSONAL matter and everyone's context, individual needs, coverage requirements and capability to pay is DIFFERENT. As such, I can only share my own situation for reference or case study, hopefully this can trigger deeper thoughts from readers. It is my modest hope to 抛砖引玉, i.e. to throw out a brick and get jade thrown back (idiom), meaning to attract others' interests or suggestions by putting forward one's own modest ideas to start the ball rolling 🥰

Long-term care insurance: While most of us should be familiar with common insurance policies covering Life, Personal Accident, Hospitalisation/Shield, Critical illnesses, I believe that there is still pretty low awareness or uncertainty on long term care insurance as highlighted by SingLife in the Biz Times article. Long term care insurance in its current form is Eldershield Life/Careshield Life which covers us with protection and assurance for life if we develop severe disability (i.e. unable to carry out 3 of the 6 activities of daily living (ADL) such as bathing, dressing, eating, toileting, moving around and transferring to & fro bed/wheelchair.

Careshield Life (fully payable by Medisave and compulsory for those born after 1980 once they turn 30 years old) provides monthly payouts of $662 for life where we need personal and prolonged medical care, especially during old age (for more info on Careshield Life, pls refer to CPF website here: CPFB | CareShield Life ).

However, if we think deeper, is $662 a month sufficient for our medical care, helper, mobility aid/equipment should we develop long term disabilities, not to mention our daily expenses and other financial needs, esp in view of inability to work? Hence, it is for this reason that I upgraded my Careshield Life with 1 of the 3 insurer providing supplements to provide higher payout and some plans requiring only inability to carry out 2 (instead of 3) out of the 6 ADL activities. I see it as an long term investment in the event of long term care needs! You can find the providers of these supplements and more details here: CareShield Life Supplements | Ministry of Health

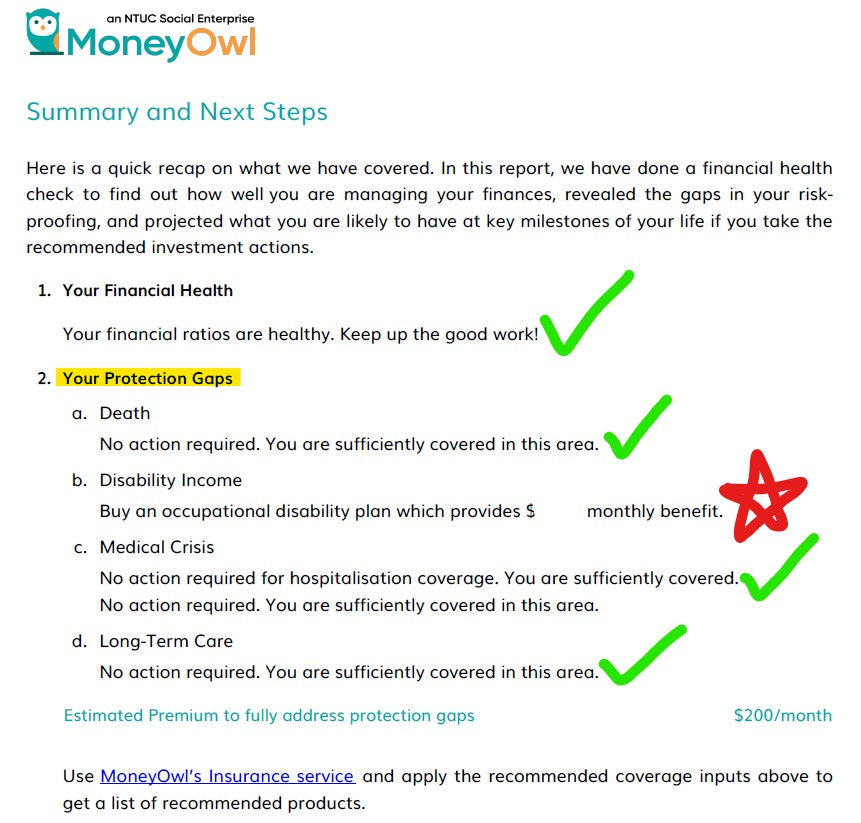

Back in 2023, I did a comprehensive financial planning review with Moneyowl to analyse my financial health, investment portfolio, retirement adequacy, insurance coverage etc. For those of you who remember, Moneyowl was a fee only (not commission based) social enterprise advisor founded by NTUC to help raise financial literacy amongst Singaporeans and to promote financial awareness in insurance, investment, will-writing etc.

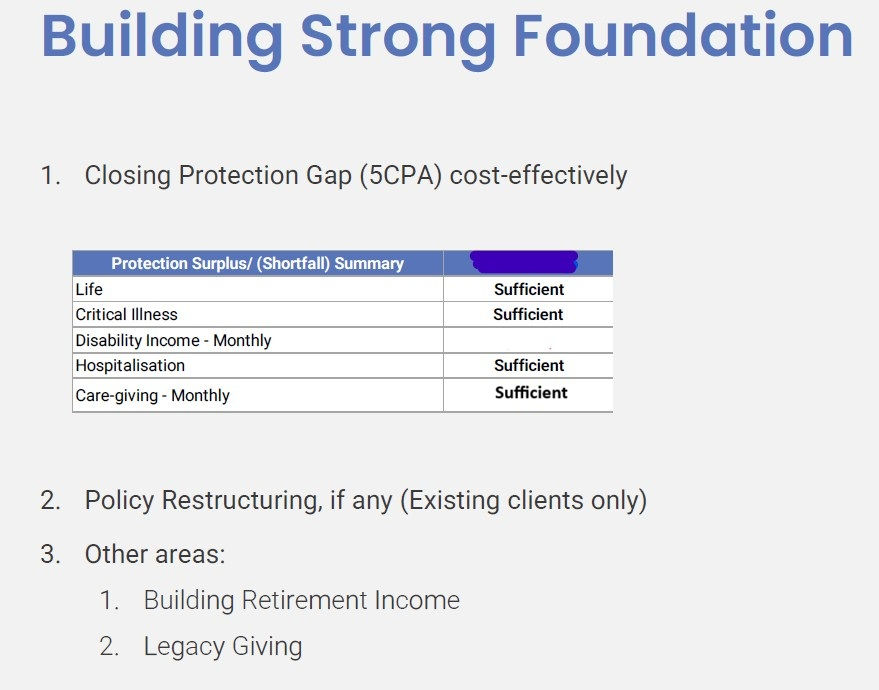

After analysis of my insurance policies/coverage and personal/family needs and situation, the Moneyowl advisor concluded in my financial planning report above that I was adequately covered for my Life insurance, critical illness, personal accident, medical/hospitalisation shield plan and long-term careshield needs but I was lacking disability income insurance.

Alas, while I was considering whether to take up disability insurance policy to cover a % of my income in the event that I am unable to work due to accident or illness, there was a change in the Moneyowl and after which by a twist of event, Moneyowl closed down subsequently due to lack of long term sustainability as a social enterprise in Singapore (you can google for more details on what happened to Moneyowl if interested).

Recently, I got in touch with Havend (Havend - Insurance Advice, Better Experienced™ - Havend), a specialised insurance advisory, operating independently from any particular insurer to conduct another independent assessment of my insurance coverage and identify any protection gaps.

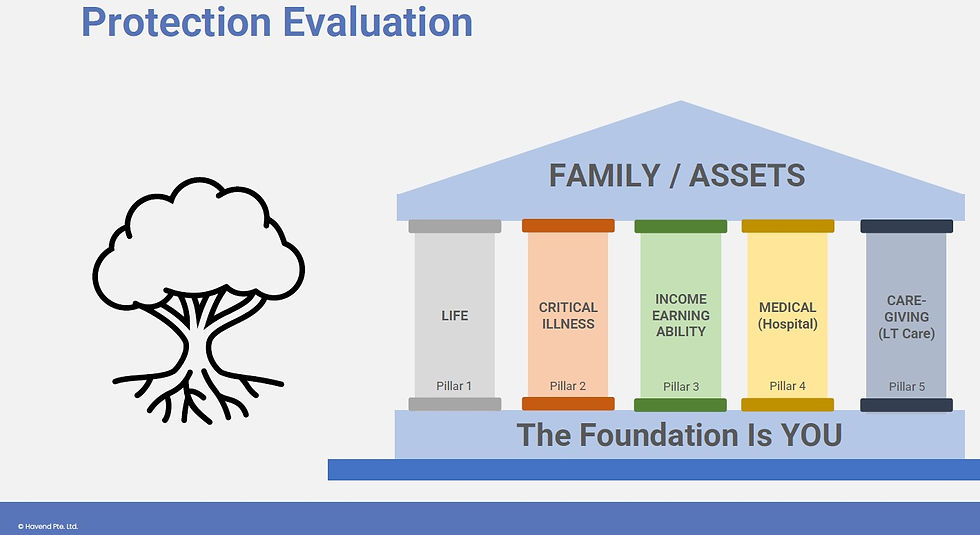

Components and details of the 5 pillars of our various insurance needs

Disability Income Insurance: I recall there is a saying - No matter how highly paid you are, e.g. you could be a lawyer earning $100K per month, or a doctor earning $200K per month, but if you are unable to work or stop work, your net worth diminishes drastically with time once your income stops. It is for this reason, why disability income insurance policies came about. However, I believe this type of insurance is even less known than the long-term care Careshield Life mentioned above.

Essentially, when you buy a disability income insurance, you pay a premium for the insurance company to cover you a monthly benefit of $X,000 (up to you to choose) for a number of years (your choice depending on when you target to stop working/retire) in the event you are unable to work and lose your income due to illness or accident.

Some may ask, how is this disability income insurance different from Careshield Life policy? Whilst I initially see some overlap in coverage, but on deeper thoughts there are areas not covered under Careshield Life (which I would see as more severe).

For e.g. (i) If you are a teacher but you lose your voice and cannot teach or (ii) If you are an admin staff but you lose your fingers and unable to type/write or (iii) If you are a property agent but lost the use of 1 leg and unable to run sales due to some illness or accident; without Disability Income insurance, Careshield Life would likely not cover you as you are still able to do at least 3 of the average daily living activities (ADL) such as bathing, dressing, eating, toileting, moving around and transferring to & fro bed/wheelchair.

To make things worse, what if such disability due to illness/accident happens to one when we are younger and we lose our income, with young children as dependents and elderly parents to provide for? Not to mention rising medical costs, helper cost, inflation? I believe even if one has a million-dollar investment portfolio to provide passive income should we lose our job, it will also diminish drastically to last the decades ahead of us! 😱

Interestingly, it was not the advisor who bugged me to buy the disability income insurance after the review. After balancing the pros and cons and running some financial analysis, I sought out the advisor to clarify some queries before asking him to help me buy the disability income insurance. While such plan has no cash value, I figure it would cover me and my family a portion of my income to an age when I plan to stop work. Of course we buy insurance hoping that we would not need to use it! But I personally believe in its need and its place as part of my investments in our insurance protection needs.

I live by the maxim - "Nobody cares about your money and health more than you! With this in mind, revisiting some the earlier comments/lamenting by friends/family on the article of many being underinsured and underprepared. Whilst I agree that we should never ask the barber whether we need a haircut or ask a beautician if we need a facial (of cos they will say yes!🤣), but if we do not believe any survey result or analysis report, we should take steps to confirm/refute our beliefs or ascertain the sufficiency of our insurance coverage by either doing our own homework, asking for advice or seeking third-party professional opinions. Ultimately, REMEMBER - We are not just protecting ourselves by insuring our various long-term protection needs, we are also investing for the future and protecting our loved ones who will have to look after us and journey through with us! 😉

To your money and health,,

Nobody cares about your money and health more than you! 😉

Mr MoneyandHealth (Mr MH)

Disclaimer: The author is NOT endorsed by any insurance company/service provider/MOH/CPF to write this post. The above article is NOT financial advice, and is purely the author expressing his layman views own opinions and sharing his own situation and context. While the author has tried his best to provide accurate information and up to date details, readers shall do your own due diligence to ascertain the accuracy and facts before taking any actions. Please consult a qualified financial advisor or insurance agent for advice before purchasing any insurance policies, making any moves or taking any actions. Pls note that past performance is not an indicator or guarantee of future performance or potential.

Comments