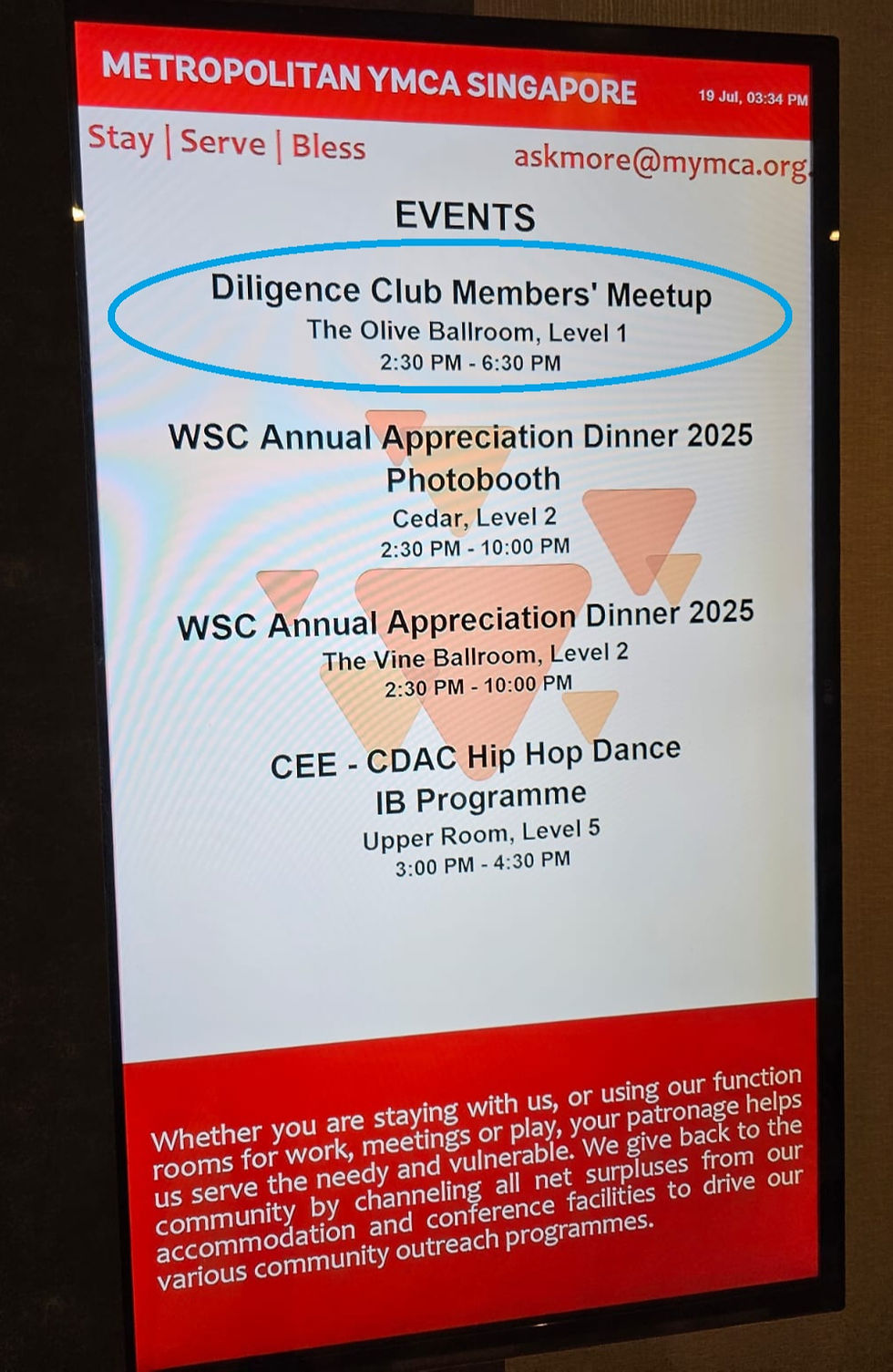

My 10th Year Investing milestone: On stage as panelist for Diligence Investment Membership club meet-up(19 Jul 25)

- ckcbiz40

- Jul 21, 2025

- 10 min read

Wow, what better way to commemorate my 10th year of investing journey than to be invited as 1 of the 4 panellists of our Diligence Investing members club to share insights, perspectives, lessons learnt, best buys and advice with fellow investors/members? 😎

What started with a simple invitation by @Willie (https://www.dividendtitan.com) resulted in me greatly privileged and honoured to be invited to share insights and my investing journey. Thereafter, it cumulated into a few days/nights of homework/collation/preparation for the questions to be answered and ultimately led to the BIG day on 19 Jul 2025!

Sneak peak of the questions that Willie came up with for panellists to prepare for the sharing session:

(1) A brief introduction of ourselves (personal, work-wise, background etc.)

(2) How did we get started and the challenges along the journey?

(3) 1 worst investing mistake, and 1 winning investment?

(4) What is in our portfolio(s) - Countries, sectors, rough number of stocks etc?

(5) Best stock performer(s)?

(6) Favourite stock idea for the moment?

(7) Advice to investors who want to or those just started investing?

Some friends asked what I shared during the session, so instead of just sharing with Diligence members present at event, I thought why not share it in this blog post here, and also to add on some parts that were missed out due to shortage of time at the event.

Hope this would help/guide more people out there who may be blur and lost about investing, or misguided/misunderstand investments as gambling, or just simply folks who wish to learn but don't know where to start! 😀

I was privileged to be part of the panel with GL, EG and AL on stage for the fireside chat cum panel sharing. During the sharing, realised that each of us are at different phases of investing and different stages of life, and with diverse work/personal backgrounds and came with varying experiences/perspectives!

So here goes on what I shared during the session, and some parts that were missed out due to shortage of time. In the essence of time, you can jump to the answers to any of the questions that you might be interested to find out more below!

(1) A brief introduction of ourselves (personal, work-wise, background etc.)

(a) I am part of the sandwiched generation in mid-40s, married with 2 kids. (b) Engineering trained with no finance background. I've always suan-ed my friends and family members around me who were finance trained that it would be so much easier for finance trained folks like them to pick up investing! In fact, I wrote a previous post on the lack of financial literacy during our school lives here (ckcbiz40.wixsite.com/moneyandhealth/post/ever-wondered-why-why-was-and-still-is-financial-literacy-not-taught-in-schools)

(c) I started with dividend investing 10 years ago => branched into short term momentum/position trading during Covid pandemic => then diversified into capital gains long term investing over the past 2 or 3 years.

(d) I was in working in the Public sector for more than a decade, then now in Private sector and was in various fields of work dabbled into a bit of environment, land leasing, property management and aviation/aerospace etc.

(2) How did we get started on investing and the challenges along the journey?

This was the part I didn't get to share during the event due to the sequence of questions, so here goes:

(a) Although friends and colleagues tried to introduce investing to me in my early years of working in 2000s, I was stubborn/lazy/busy (add whatever excuses you can think of) and refused to learn or thought of investing as gambling and just brushed it off.

(b) It was only until 2014/2015 when 2 of my friends RC and WK (whom Mr MH is forever grateful to) finally managed help me achieve the AHA moment of the power of investing and dividends. (c) I still remember vividly, my army friend, RC delivered the book:- Millionaire Teacher by Andrew Hallam to my house on Xmas eve in 2014, as a Christmas present hoping to share the benefits of investing with me. After I read the book, it dawned on me as I was impressed at how we could make money work hard for us! (d) My other friend from JC, WK started to share with me how he was investing through OCBC's Blue Chip Investment Plan (BCIP_, and he got me started with buying STI ETF (paying about 4% to 5% dividends then) and WK patiently guided me along the way and got me going!

(e) From then on, there was no turning back as I got more passionate and interested in investing and became enlightened to the power of making our money work for us, rather than working for money! I realised that there's a limit to how much time we can sell to earn money (max 24 hrs per day!) but there's no limits on how much our money can earn for us as we eat/sleep/travel/play etc!

(3) 1 worst investing mistake, and 1 best investment lesson?

When Willie asked this question, to make it more interesting for the audience, I decided to turn it into a quiz to poll the audience who would buy 1 of the 2 stocks that would turn out drastically different outcome!

Features of the 2 stocks are in the table below, why not take a guess which one would U choose to invest in? 😉

Stock A | Stock B |

A furniture maker + interior fit out specialist | A healthcare company in a defensive sector |

Net cash company paying about 11% yield in 2016 | Was yielding about 5% at the point when I was considering to buy in 2015 |

Supplies to past projects include (Hotels - Marriot, St Regis, MBS, Ritz Carlton, Capella, Westin,Sentosa W Hotel, Equarius Hotel, Mandarin Orchard), (Condos – Interlace, Sky Habitat, Bedok Residences, Gramercy Park). | Price plunged due to Black Monday in August 2015 (global stocks fall due to contagion of China fears - Chinese stocks tumble for a second day after global fall - BBC News) |

Controlling shareholder which was listed in Dubai owned about 89% of the stock. | Portfolio was stable but not growing rapidly but dividends had been growing since IPO for 8 years |

So, which would you choose to invest in yourself? Stock A or Stock B? Don't peep for the outcome!

.

..

...

....

.....

......

When polled by Willie, majority of the audience chose Stock B. So what's your choice? 😉

RESULT:

(i) Worst Mistake - Stock A was a small cap company called Design Studio Group.

With the above parameters in mind, I first bought into Design Studio in 2016. Then when its prices dropped in 2017 and 2018, its dividend yield went up to 13%, 14%, I averaged down and bought more! I still remember I told my friend that based on my 14% yield, my investment would be free of charge in 7 years! 😱

What happened next? The company started losing money in 2018 and 2019, went into trouble with business and the industry downturn, with key management staff leaving the company, and it went into a restructuring exercise in 2020. Though the parent company gave it loan(s), the business was still not sustainable, and shares was suspended in 2020. Finally, the company was wound up in 2021, as it was unable to pay its debts and became insolvent.

Outcome? I lost about $7K in 1 of my earlier investments but on hindsight, it was tuition fee well paid on hindsight for the lesson learnt and battle scar earned 🤣

(ii) Best investment lesson = Stock B is Parkway Life REIT.

Despite the Black Monday plunge in August 2015 (described in table above), I soldiered on to buy Parkway Life REIT at $2+ when its price dropped (as Dow plunges on rollercoaster trading on ‘Black Monday’ together with global markets and hundreds of billions of dollars were wiped off global stocks due to panic that started in China spread across the world.

What happened next? Parkway Life went on brilliant run of uninterrupted growth of dividends for 17 long years since its IPO in 2007 till 2024 and counting, through Covid-19, global financial crisis etc! Slow and steady, but its dividend per unit (DPU) grew by about 120% from 6.83 cents (2008) to 14.92 cents (2024)!

My Outcome? My dividend yield in Parkway grew from 5+% to 7+% and the best part? I foresee the dividend yield to keep growing for the next almost 20 years after their signing of the new Master lease agreement a few years ago and its rent reversion being pegged to inflation/CPI adjusted figures!

Bonus? I'm sitting on a paper capital gain of >90% as Parkway's price has risen and stabilized at $4+ now.

(4) What is in our portfolio(s) - Countries, sectors, rough number of stocks etc?

(a) Singapore stocks (6-digit portfolio) = Comprises of 29 stocks (for recurring dividend income), which I see it as my own diversified Straits Times Index (STI)! 🤪 Sectors include: Property stocks/Reits= 50%, Finance = 17%, Others = 33%.

(b) US, HK, China stocks (5-digit portfolio) = 30+ stocks (mainly for long term capital gains), some stocks for short term momentum/position trading.

(c) Roboadvisors (Endowus, Moneyowl) (6-digit portfolio) = Monthly dollar cost averaging into ETF / Unit Trust comprised of World Index, S&P 500, Dimensional funds, Developed World Index, Emerging Markets basket, Bond Funds etc.

(5) Best stock performer(s)?

This part was missed out during the fireside chat due to shortage of time, but here goes.

I actually recently did a blog post about 2 months ago on my best performing stocks in my First 11 in football team (My football team(stock portfolio)'s Starting 11! Can our reserve players substitute them? 🤔), and so when Willie posted this question to prepare, I went to relook at it and was able to quickly update it below:

(a) Dividend Yield wise:

1st | 2nd | 3rd |

OCBC = Approx. 9.3% | DBS = 7.8% | AIMS APAC REIT = 7.4% |

(b) Capital gains wise:

1st | 2nd | 3rd |

ST Engineering = 143% | Hong Kong Land = 104% | Parkway Life REIT = 92% |

(6) Favourite stock idea for the moment?

I'm a believer that data is the new gold, and with the advent of AI and technology and the high specs, specialised requirements and stickiness of customers, increasing demand, I believe Data Centre business the new bedrock of our portfolios.

Hence, my favourite stock idea for the moment would be the recent largest IPO on SGX to-date, NTT Data Centre REIT projecting a yield of 7.5% to 7.8% yield. Funny thing was, the IPO opened while I was in Chengdu on 7th Jul and since IPOs usually open for about 1 week, so thought I could still come back and analyse it before deciding whether to apply for it. Little did I realised that the IPO was only opened for a short 2.5 days and closed before I returned to Singapore! Not surprisingly, the limited public tranche was 8 to 9 times oversubscribed. But guess what, lo and behold, NTT DC REIT debuted flat on 14th Jul and closed at its IPO price of USD$1. Then in subsequent days, it dropped to USD$0.95 by 18th Jul (the day before our event). Well, as the Chinese idiom goes:- “塞翁失马,焉知非福”, i.e. Every cloud has a silver lining. The setback of me missing out on the IPO application may turn out to be a blessing in disguise 😂 Nonetheless, with some risk factors and the tepid debut, I see it as a future oppty to enter when the price is right! But at what risks? What right price? Chat me up to find out! 😉😂

(7) Advice to investors who want to or those just started investing?

Willie added a twist this question during the event by asking 4 of us panellists what advice we would dish out to our younger self? But I guess my answers prepared below would still apply!

(a) Start young, start ASAP (in fact, as EG also shared, I regretted I started too late). Why start young? Other than the usual advice of letting your capital and dividends compound, I added another perspective of letting our mistakes and blind spots compound when we start earlier! Let the lessons and tuition fees paid along the way compound so that we can take heed from history and not repeat the same mistakes down our long investing journey!

(b) Keep learning from experts (like Willie!), from like-minded friends, from online resources and also to read more books to expose yourself to different styles of investing. And also to keep exploring to find an investment style and methodology that suits your risk appetite, your style and your situation.

(c) Ride on the shoulders of giants - See investing memberships (shoutout to Willie’s Diligence membership!), subscriptions, platforms/systems as biz costs. Personally, I see my investing journey as a business, and in every business, there are costs to be spent in order to generate revenue and make profits, you get the idea?

(4) Control your emotions, keep calm and carry on (cue my Best investment lesson on Parkway Life REIT investment above?), and don't FOMO (remember the blessing in disguise when I missed out on NTT Data Centre's IPO above?) 😉

Thank you for reading this far. If you are keen to find out more on Diligence membership, do link up with me at - ckcbiz40@gmail.com to find out more!

Lastly, just wanted to share my heartfelt sentiments - Investing is a long and lonely journey, its usually misunderstood by many as gambling and the importance of investing is often under-stated (think inflation, retrenchment, setbacks in life) and often neglected or avoided. So it's heartening to have like-minded people out there or a supportive community to walk alongside you, to bounce off ideas, to appreciate your views/insights and check your blind spots!

Thank you for reading and giving us these intangible rewards for truly passionate people when our research, interests and efforts to raise financial awareness amongst us are truly valued. Its deeply rewarding 🥰

Disclaimer: The above article is just the author expressing his layman views. It is NOT financial advice, and NOT a recommendation to buy or sell any stocks or REITs. Pls do your own due diligence and/or consult a qualified financial advisor before making any moves or taking any actions. Pls note that past performance is not an indicator or guarantee of future performance or potential.

To your money and health,

Mr MoneyandHealth (Mr MH) 🥰

Comments