Temasek's Astrea 9 PE Bonds - 5Ws and 1H - Who? What? Where? When? Why Buy? How to Buy?

- ckcbiz40

- Aug 2, 2025

- 13 min read

By now, if you are in the investment community or even bond buyers or fixed deposit savers, you should have heard the recent hype about the Astrea 9 private equity (PE) bonds newly launched by Azalea, an indirect subsidiary of Temasek.

You can find more information on the official website here: https://www.azalea.com.sg/a9 and refer to the 10-page Product Highlight Sheet (aka Summary) and 368-pages Prospectus (the detailed booklet on the description of the bond, its risks, returns and product details etc.)

But, people nowadays with our busy schedules, short attention span (read as lazy 😆), unfamiliarity with private equity bonds or pure shock on needing to read the 300+ pages prospectus would either be turned off or scratching their heads. 😅

As it turned out, I have been busy answering many queries from friends/family members regarding the Astrea 9 bonds over the past few days (before and after launched) that I've became like a helpdesk 🤣 So some friends suggested why not I post a blog on this?

Well, ask and you shall receive! So here goes... But I will not be doing the usual whole comprehensive introduction, explanation, pros and cons of the whole PE bonds to bore readers. For these, you can refer to the news articles or fellow bloggers who did a great job giving the framework and the nitty gritty: - Astrea 9 PE-backed bonds offer attractive yields for retail investors - The Business Times - Azalea prices Astrea 9 class A-1 and A-2 bonds at 3.4% and 5.7% respectively

For my post, I will get down to the commons questions I've been asked or frequent queries that I saw popped up in the investment community/forums. Take it as a FAQs section to solve your burning questions and I try to word it as layman as possible. In addition, I also try to scour the product highlight sheet and prospectus for the key details worth highlighting. For ease of searching, I broke it down into 5Ws and 1Hs (Who, What, Where, When, Why and 1 How to buy?) 😁.

(1) WHAT - to buy?

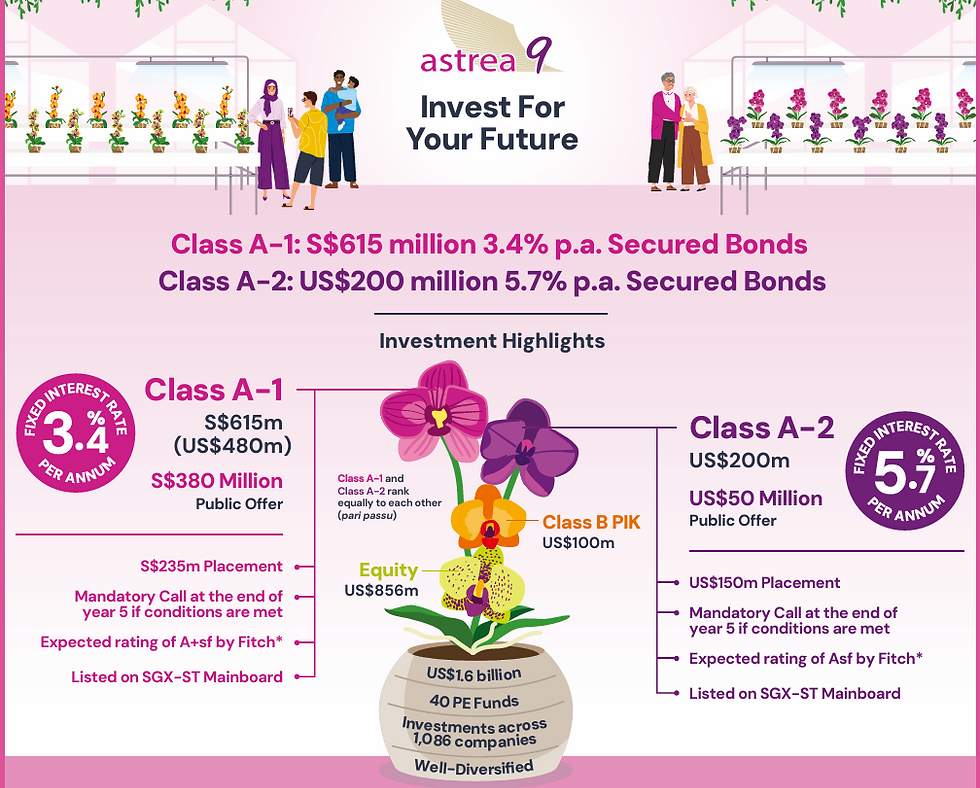

Astrea 9's Class A-1 Bonds (with an interest of 3.4% per annum) are denominated in Singapore Dollars (SGD), and issued in multiples of S$1,000. Interest payments and principal repayments on Class A-1 Bonds are in SGD (i.e. no forex risks, hence Class A1 has a lower interest rate than Class A2 bond of 5.7% below).

Astrea 9's Class A-2 Bonds (with an interest of 5.7% per annum) are denominated in US Dollars (USD), and in multiples of US$1,000 in excess thereof. Minimum application of: US$2,000 in multiples of US$1,000). Investors will pay in SGD at the Fixed Exchange Rate of SGD1,285.20 : USD$1,000 of Class A2 bond. Interest payments and principal repayments on Class A-2 Bonds are in USD (i.e. the half-yearly interest payments and principal repayment after 5 years or beyond, if redeemed is subject to forex risks, hence higher interest of 5.7% than Class A above).

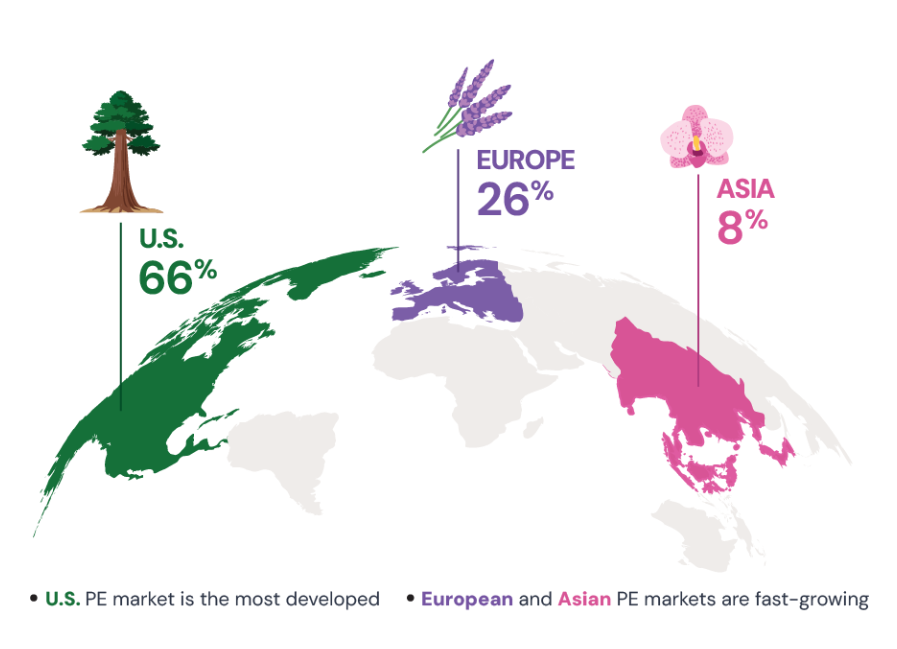

If you know what a bond is, think of it as lending them your money in the form of Astrea 9 PE bonds for them to invest in a quality diversified portfolio of 40 Private Equity funds backed by cash flows and managed by 31 reputable asset management partners/fund managers. These funds have invested in 1,086 companies across various regions and sectors. The total portfolio Net Asset Value (NAV) is US$1.625 billion. Geographical wise, 66% of it is in the U.S., 26% in Europe and the balance 8% in Asia.

Did you know?

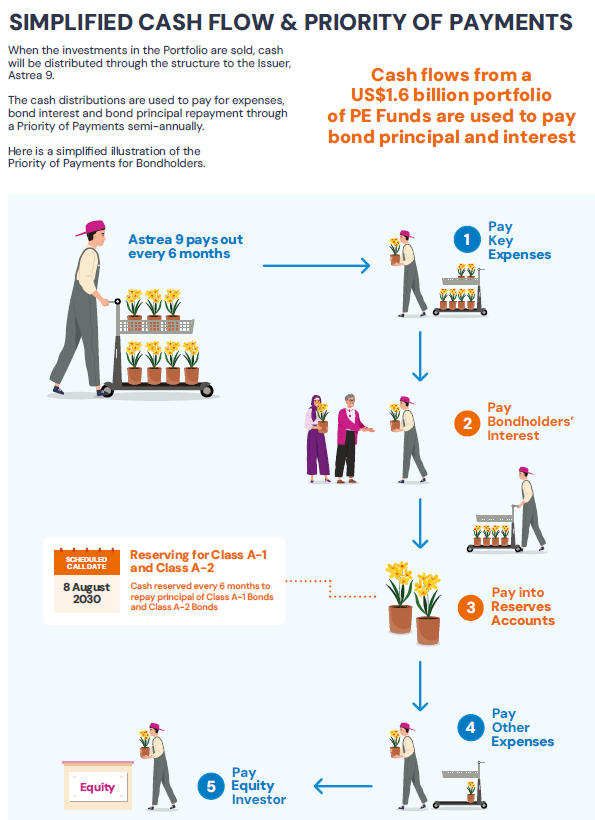

Astrea 9 has put in place requirement for cash to be reserved in the Reserves Accounts (you can see it as a savings account after deducting all your expenses) to enable the Issuer to build up sufficient reserves to redeem (i) the Class A-1 Bonds on the Class A-1 Scheduled Call Date after 5 years (8 August 2030), and (ii) the Class A-2 Bonds on the Class A-2 Scheduled Call Date after 5 years (8 August 2030), respectively.

(2) WHY - buy?

Buy Astrea 9 bonds if you wish to receive regular half-yearly interest income at a fixed rate from Class A1 (3.4% per annum in SGD) and Class A2 (5.7% per annum in USD), rather than capital growth, through cash flows from private equity funds (“PE Funds”). Astrea 9 PE Bonds (“Bonds”) are asset-backed securities backed by cash flows from a US$1.625 billion portfolio of investments in 40 PE Funds, as described in the Prospectus. The Issuer of the Astrea 9 Bonds is Astrea 9 Pte. Ltd. and long story short, who is indirectly wholly owned by Temasek Holdings (Private) Limited (“Temasek”) 😉

In addition, for those who buy Class A2 bonds, you would want to have exposure to US Dollars and are prepared to accept future changes in exchange rates between US Dollars and other currencies (including Singapore Dollars) but should be aware that they may be subject to exchange rate fluctuations between their investment currency base and the US Dollar. Such fluctuations may result in foreign exchange losses for Class A-2 bond holders.

(3) WHO - should buy?

Class A1 Bonds are only suitable for investors who are: (a) prepared to lose their principal investment if the Issuer fails to repay the amount due under the Class A-1 Bonds;

(b) are prepared to hold their investment in the Class A-1 Bonds for a period of at least five years or longer (up to 15 years) and are prepared to exit their investment only by sale in the secondary market which may be unprofitable (subject to prevailing market price) or impossible (due to low buy/sell volume).

Class A2 Bonds are only suitable for investors who are:

(a) prepared to lose their principal investment if the Issuer fails to repay the amount due under the Class A-2 Bonds;

(b) are prepared to hold their investment in the Class A-2 Bonds for a period of at least five years or longer (up to 15 years) and are prepared to exit their investment only by sale in the secondary market which may be unprofitable (subject to prevailing market price) or impossible (due to low buy/sell volume);

(c) are prepared to accept that while the Class A-1 Scheduled Call Date (i.e. the earliest redemption date by Issuer) and the Class A-2 Scheduled Call Date fall on the same date, the Class A-2 Bonds may be redeemed at a later date than the Class A-1 Bonds due to the Class A-2 Call Date Exercise Conditions not being satisfied until such later date;

(d) are prepared to accept that the Class A-2 Bonds are expected to have a lower credit rating than the Class A-1 Bonds, which is associated with a relatively higher risk profile as compared to the Class A-1 Bonds.

(4) WHEN - to buy?

Offer period: 31 July 2025, at 9.00 a.m. to 6 August 2025, at 12.00 noon.

Other important dates:

(a) Class A1 bond: Mandatory Call after 5 years (8 August 2030) if conditions are met. If not redeemed after 5 years, there will be a 1.0% one-time interest step-up. Legal Maturity 15 years (8 August 2040)

(b) Class A2 bond: Mandatory Call after 5 years (8 August 2030) if conditions are met. If not redeemed after 5 years, there will be a 1/0% one-time interest step-up. Legal Maturity 15 years (8 August 2040)

Did you know?

Astrea has a strong past track record of redeeming their PE bonds at their first call dates, see their past track records:

Astrea III (2016) – Redeemed at first call date.

Astrea IV (2018) – Redeemed at first call date.

Astrea V (2019) – Redeemed at first call date.

Astrea VI (2021) – Class A bonds fully reserved for redemption in 2026.

Astrea 7 (2022) – Actively setting aside reserves to prepare for redemption in 2027.

Above track record shows that they have the capability and discipline to meet its commitments.

(5) WHERE - to buy?

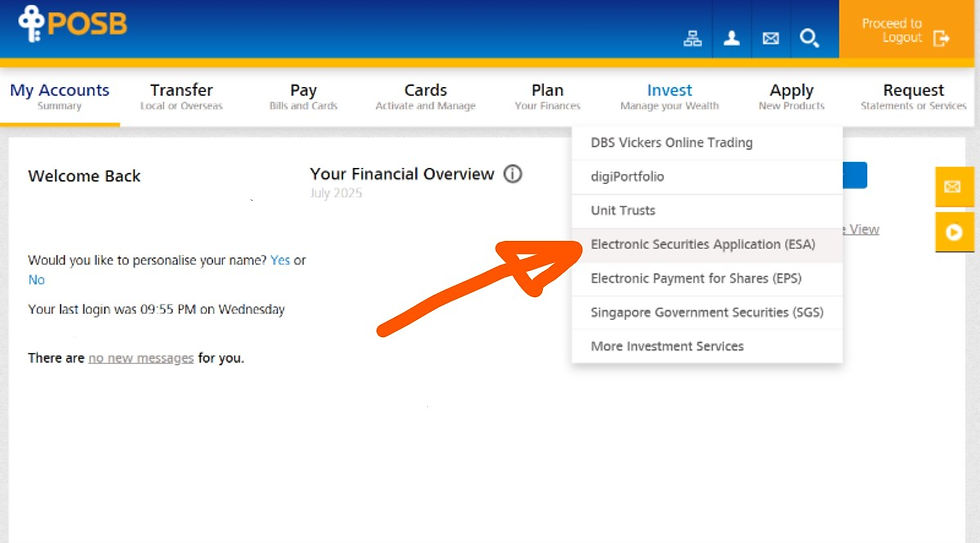

Via the 3 local banks - DBS/POSB, OCBC or UOB's ATMs, Mobile Banking or Internet banking site.

(6) HOW - to buy?

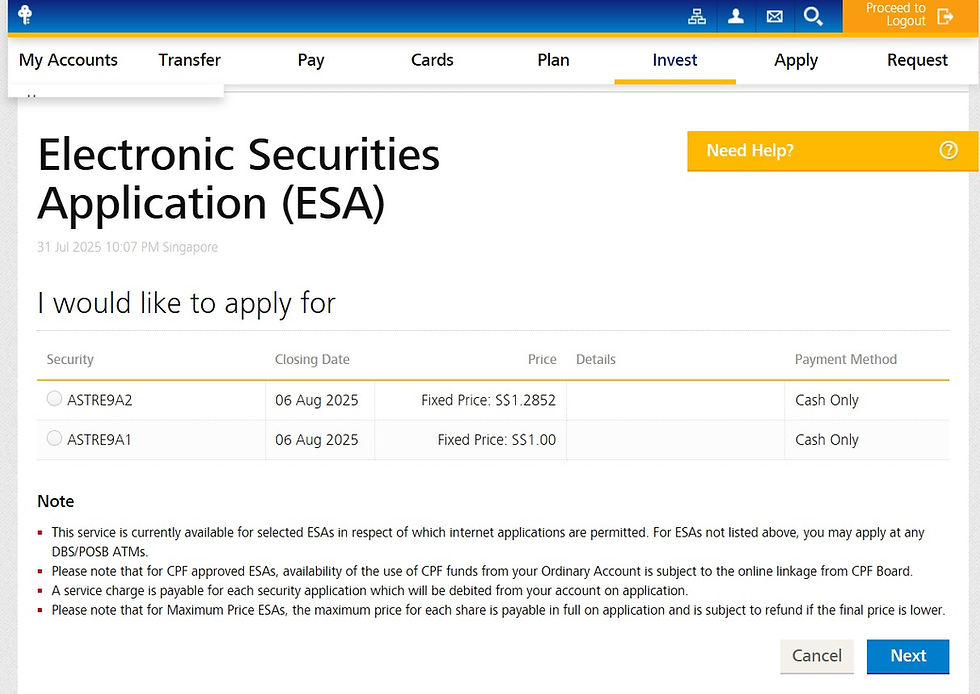

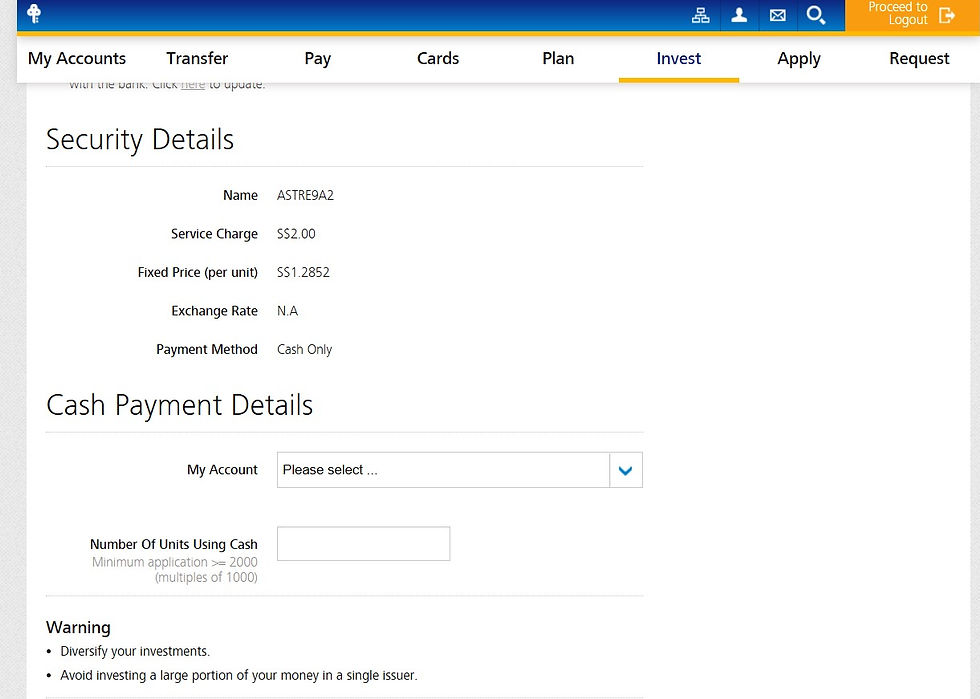

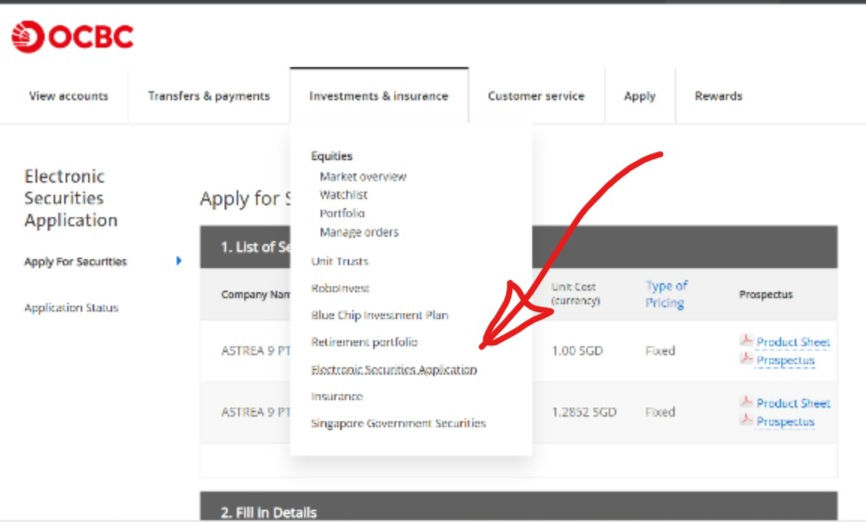

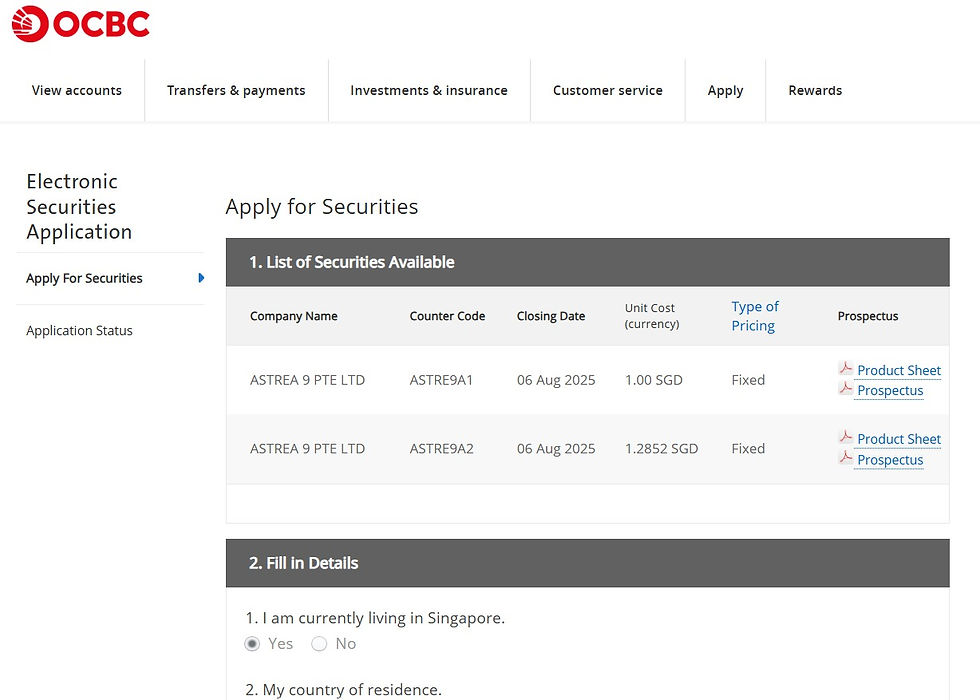

Saw many questions how to buy on Internet banking, possibly from newbies or those who have never bought IPO/such bonds before, so I decided to a step-by-step guide for applying via POSB and OCBC Internet banking below.

via POSB Internet Banking:

via OCBC Internet Banking:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Bonus questions: Qn: Is my capital guaranteed?

Ans: The official answer is NO, Astrea 9 bonds are not guaranteed or insured by any party (including the Sponsor or Temasek). But the unofficial answer? See their track records above of redemptions above.😉

Qn: Do I need to wait 15 years for the bond to mature before I can get back my money? Can I sell them on the stock exchange before maturity?

Ans: Theoretically, you need not wait for 15 years to get back your money, because at the 5th year call date of 8 August 2030, Astrea can redeem the bonds if they have built up enough reserves to buy back from you, which Astrea had been doing for the past tranches (see above track records).

However, if they do not redeem at the 5th year, or you need your money back earlier, you can sell it on the SGX stock exchange thru your brokerage before that. BUT do note that you may suffer a loss or make a profit depending on the prevailing price that you sell (think Demand vs Supply) and also note that the buy/sell volume for such bonds may not be that high or as liquid as your usual stocks.

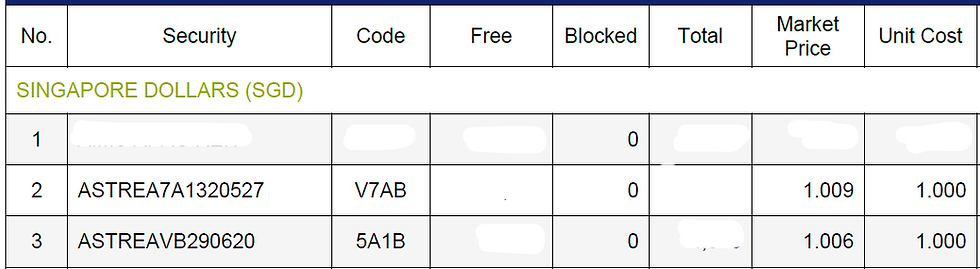

Personally, for sharing I had sold Astrea V and Astrea 7A on the market (queued some time to reach my target price) and used the money to buy higher yielding stocks/bonds. Back then, I had sold my Astrea bonds for a tiny profit (sold at market price above cost price of $1 see below), haha. But do note that just as the bond price can rise above $1 cost price, you never know when it could drop below $1 and you would make a loss if you are forced to sell (e.g. need money for emergency)

Qn: Which Class should I buy? Class A1 or Class A2?

Ans: As mentioned above under Who should Buy? If you are afraid of forex losses (to your semi-annual interest and/or your capital amount upon redemption on 5th year or later/maturity in 15 years), you can buy the Class A1 bond with a relatively lower yield of 3.4% per annum. However, if you are bullish on the USD or are able to live with the potential forex losses (to your interest and/or capital amount upon on 5th year or later/maturity in 15 years), you can consider the higher yielding 5.7% from Class A2 bonds.

Qn: How much should I buy?

Ans: Buy with the amount of money that you do not need or intend to touch for at least the next 5 years (if they redeem in Year 2030) but could potentially stretch to the next 15 years (if they do not redeem till maturity in Year 2040).

Qn: What are the chances of me getting full amount I applied for? What is the likelihood or odds?

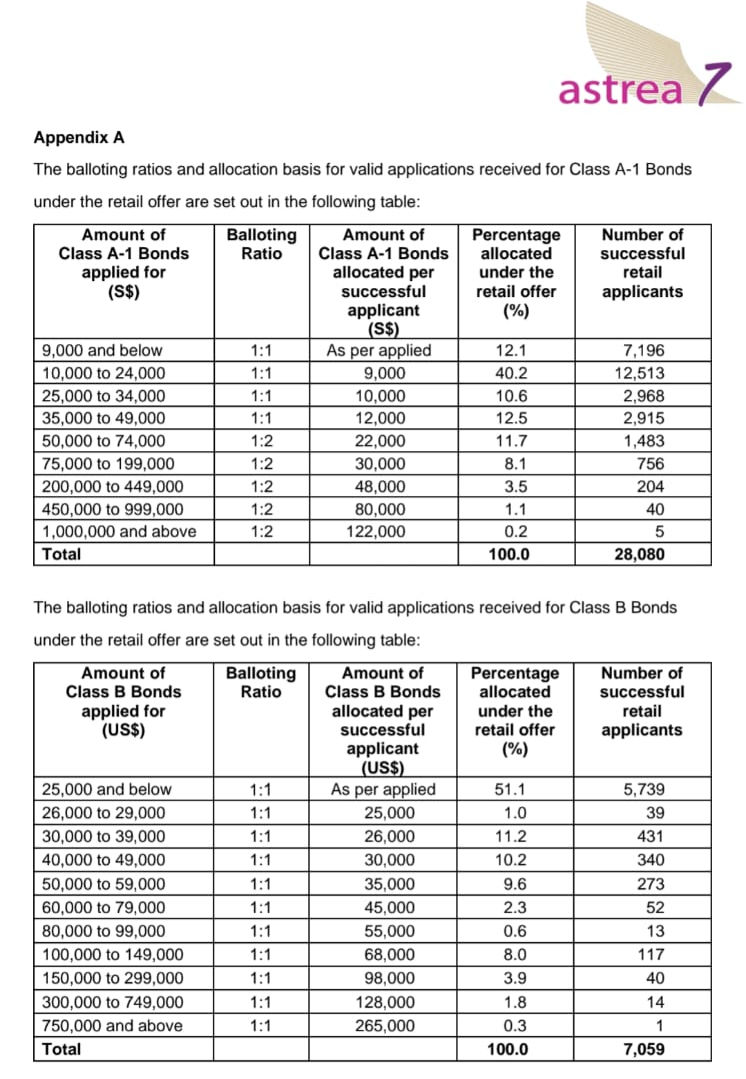

Ans: As it's based on demand and supply, good luck trying to spot the exact accurate allocation ratio or basis, but some general trends can be found from the past 2 tranches of Astrea bonds (Astrea 8 and 7 tranches details below).

(a) Generally, Azalea is trying to reach out to retail investors to participate in their PE bonds (usually meant for accredited investors or big boys with a minimum amount of $250K a pop), so smaller application amounts tend to be filled in full, e.g. for Astrea 8 and 7 below, those who applied for SGD$9,000 and below got the full amount.

(b) With higher demand for the US dollar denominated Astrea 8 Class A-2 bonds than Astrea 7's Class B USD bond, the allocation for Astrea 8's A2 was lower (applications of USD4000 and below got full allocation) than for the Astrea 7 Class B bonds (applications of USD25,000 and below got full allocation).

(c) Balloting was also conducted for investors who applied for USD50,000 or more of Astrea 8 Class A2 Bonds, whereas all valid applicants who applied for Astrea 7's Class B Bonds received allocations either in full or in part.

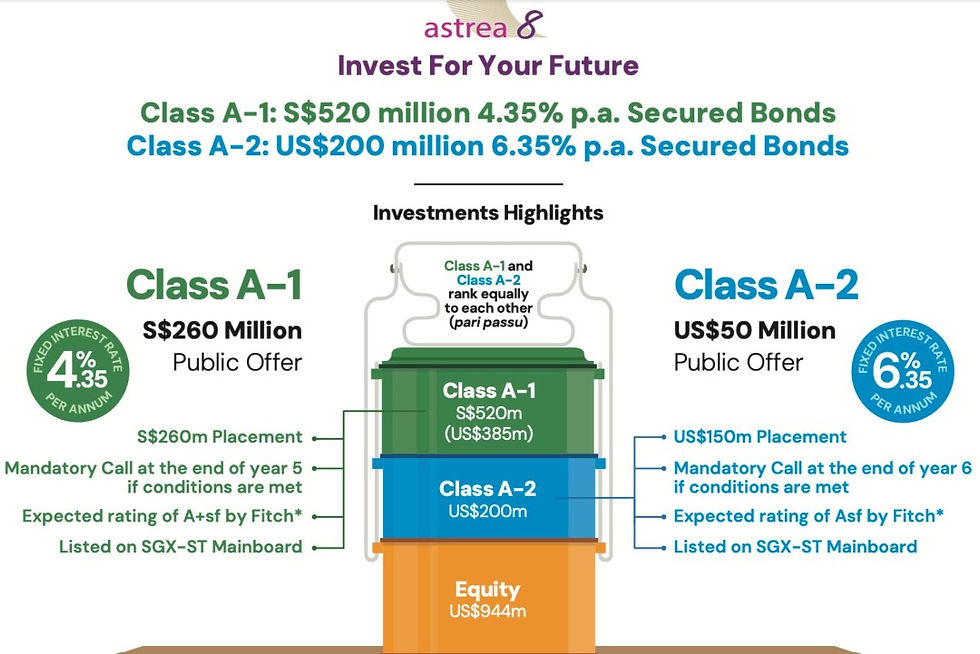

Astrea 8 (in 2024):

Class A1 (SGD) yielding 4.35% per annum: Applications of over S$763 million from 27,287 applicants. A subscription rate of 2.9x based on public offer of S$260 million for the Class A1 bonds.

All valid applicants who applied for less than S$50,000 of Class A1 Bonds received allocations either in full or in part.

Investors who applied for S$9,000 and below of Class A1 Bonds received full allocation.

Class A2 (in USD) yielding 6.35% per annum: Applications of over US$193 million from 9,894 applicants. A subscription rate of 3.9x based on public offer of US$50 million for Class A2 bonds.

all valid applicants who applied for less than US$50,000 of Class A2 Bonds received allocations either in full or in part.

Investors who applied for US$4,000 and below of Class A2 Bonds received full allocation.

Astrea 7 (in 2022):

Class A1 (in SGD) yielding 4.125%: $877 million applications by 30,565 applicants for Class A1 bonds. Based on the S$280 million of the Class A1 bonds in the public offer, this would represent a subscription rate of 3.1x.

Like the Astrea 8 Class A1 bonds, Investors who applied for S$9,000 and below received full allocation.

All valid applicants who applied for less than S$50,000 of Class A1 Bonds received allocations either in full or in part.

Investors who applied for S$9,000 and below of Class A1 Bonds received full allocation.

Class B (in USD) yielding 6%: There was no Class A2 offered to public, instead Class B bond was offer to public in USD.

US$126 million applications by 7,059 applicants for public offer. Based on the US$100 million of the Class B bonds in the public offer, this would represent a subscription rate of 1.3x.

All valid applicants who applied for the Astrea 7 Class B Bonds received allocations either in full or in part.

$Million-dollar question$:- Which class of Astrea 9 bond is Mr MoneyandHealth (Mr MH) applying for?

Answer: Personally, Astrea 9 Class A1's 3.4% interest rate does not appeal to me. Why? Whilst interest rates have been falling, but considering the risks/"lock-in period"/complexity of Class A1 PE bonds, its spread of 1+% above other safer/simpler instruments such as high yield saving accounts (OCBC 360, UOB ONE, DBS Multiplier etc yielding low to mid 2%) or fixed deposit rates of 2+ % from banks/finance house or even CPF OA's 2.5% does not entice me enough.

As someone who has a higher risk appetite, and vested in the equities market, I see a place of bonds in our diversified investment portfolio [as mentioned in my earlier blog: My 10th Year Investing milestone: On stage as panelist for Diligence Investment Membership club meet-up(19 Jul 25)] However, if I were to buy Astrea 9, I would demand a higher yield closer to my dividend yield of 5% to 7% from my stocks/REITs, especially since I currently also own Astrea 8's Class A2 (6.35%) and Astrea 7's Class B (6%), I am unable to accept much lower interest (even with the backdrop of dropping interest rates). Hence, Astrea 9's Class A2 (5.7%) I shall apply! 🤣

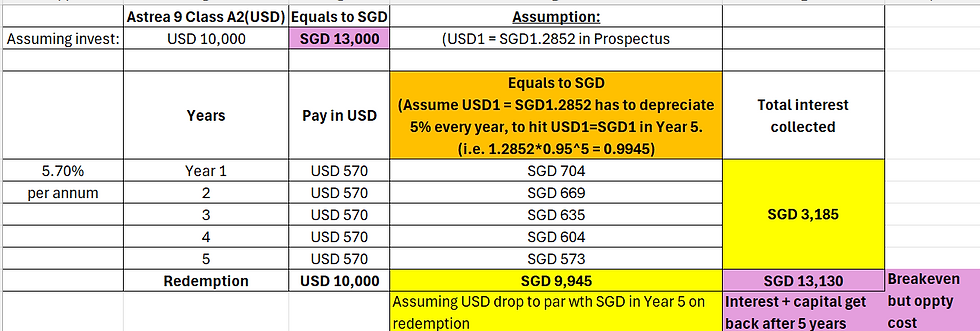

While there are some who worry that USD has been depreciating against SGD over recent years, I did some simulation on how much USD will need to drop to be on par with SGD over the 5 year period, see excel below.

What are the chances of USD depreciating 5% EVERY year for the next 5 years and USD dropping by almost 29% in the 5th year? Your guess is as good as mine! 🤔

But in line with the AI hype, if we dunno, HOW? Ask ChatGPT and Microsoft Copilot below! Just for Fun, ya?

Anyway, the above is just for fun to estimate the chances of USD vs SGD depreciating against SGD (past and future), and it's for your consideration. For me, I will be going for Class A2 (USD) but pls not that the above are my PERSONAL VIEWS and sharing out loud.

I hope the above FAQs and details have been helpful in clearing any doubts or burning questions. IF you are applying for the Astrea 9 PE Bonds, remember the deadline is 6 Aug, 12noon and MAY the HUAT be with us! 🤣😁

Disclaimer: I am NOT endorsed by any company/bond issuer/investment firm to write this post. The above article is NOT financial advice, and is purely me expressing my personal own layman views and my own opinions and sharing my own situation and context. While I have tried my best to provide accurate information and up to date details, readers shall do your own due diligence to ascertain the accuracy and facts before taking any actions. Please consult a qualified financial advisor before purchasing any bonds, stocks, making any moves or taking any actions. Pls note that past performance is not an indicator or guarantee of future performance or potential.

To your money and health,

Mr MoneyandHealth (Mr MH) 🥰

hi there, good write compared to the usual verbatim from other bloggers.

question: if we buy a2 USD at fixed FX 1: 1.28.... how about selling it say, 2~3 years later? will it be USD back into your account? or the the sales proceed will be SGD (also at FX 1: 1.28)